By Linda Barrett, Ty Leverty, and Jim Swanke

Enterprise Risk Management (ERM) has traditionally been associated with large corporations and financial institutions. In an increasingly volatile and interconnected business environment, however, small and medium-sized enterprises (SMEs) face a growing need to adopt ERM frameworks to ensure sustainability, strategic alignment, and competitive advantage.

Small businesses operate in environments characterized by uncertainty, limited resources, and rapid change. Despite their size, these businesses are exposed to a wide array of risks, such as hazard, operational, financial, and strategic, that can significantly impact their performance and longevity. Further, SMEs often lack the budget to hire a full-time risk manager.

ERM offers a structured, holistic approach to identifying, assessing, and managing risks across the organization. Unlike traditional risk management, which often focuses solely on hazard, or “pure” risks where there is only the opportunity for loss and not gain, ERM considers all aspects of risk.

Defining Enterprise Risk Management

ERM is a comprehensive framework for managing risks that affect an organization’s ability to achieve its objectives. It encompasses all types of internal and external, financial, and non-financial risks, and promotes a culture of risk awareness throughout the organization, integrating risk considerations into strategic planning and decision-making processes.

ERM is a strategic tool that enables better resource allocation, improved stakeholder confidence, and enhanced resilience in the face of disruptions.

Key Components of the ERM Framework

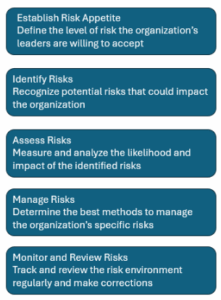

An effective ERM framework consists of the following interconnected steps.

1. Establish Risk Appetite

1. Establish Risk Appetite

Risk appetite defines the level of risk an organization is willing to accept in pursuit of its objectives. For small businesses especially, this involves balancing risk-taking with financial capacity and strategic goals.

A clear understanding of risk appetite helps prevent both excessive caution and reckless expansion.

2. Identify Risks

Risk identification is an ongoing process that involves recognizing potential threats across all business functions. Common risks for SMEs include:

- Natural hazards

- Credit risk

- Supply chain disruptions

- Cyber threats

- AI considerations

- Geopolitical climate

Formal risk identification should be complemented by day-to-day vigilance.

3. Assess Risks

Risk assessment involves evaluating the likelihood and severity of identified concerns. SMEs should adopt a standardized framework to ensure consistency across departments.

This step includes analyzing risk interdependencies and prioritizing risks based on the potential frequency and severity to disrupt operations.

4. Manage Risks

Risk response strategies include avoidance, prevention, reduction, toleration, transfer, and acceptance.

For example, a small business may choose to outsource IT functions to mitigate cyber risk or purchase insurance to transfer financial risk. The chosen responses should align with the organization’s risk appetite and strategic objectives.

5. Monitor and Review Risks

Continuous monitoring ensures that risk controls and financing remain effective and relevant. Maintaining a risk register and conducting regular reviews to update risk profiles and response strategies is useful.

Monitoring also supports accountability and transparency within the organization. Importantly, adjustments are needed to respond to new risks while maintaining alignment with strategic goals.

Strategic Importance

A notable aspect of ERM is its integration into strategic initiatives. ERM is increasingly viewed as a driver of innovation and growth rather than a constraint.

By embedding ERM into strategic planning, SMEs can align risk considerations with long-term goals, improve agility, and capitalize on emerging opportunities.

Enterprise Risk Management is not a luxury reserved for large corporations. For small businesses, ERM represents a strategic necessity that supports resilience, informed decision-making, and sustainable growth.

By adopting a tailored ERM framework, SMEs can navigate uncertainty with confidence and transform risk into opportunity.

Linda Barrett serves as the Student Affairs Manager for the Department of Risk and Insurance at the University of Wisconsin-Madison. Her role includes assisting directors of the Risk Management and Insurance MBA program, managing operations of the Creative Destruction Lab-Wisconsin, and supporting department faculty with projects and communications.

Linda Barrett serves as the Student Affairs Manager for the Department of Risk and Insurance at the University of Wisconsin-Madison. Her role includes assisting directors of the Risk Management and Insurance MBA program, managing operations of the Creative Destruction Lab-Wisconsin, and supporting department faculty with projects and communications.

Ty Leverty is the Gerald D. Stephens CPCU Chair in Risk Management and Insurance and an Associate Professor in the Department of Risk and Insurance at the University of Wisconsin-Madison. His research interests are in the economics of insurance markets, insurance company operations, and public policy issues in insurance.

Ty Leverty is the Gerald D. Stephens CPCU Chair in Risk Management and Insurance and an Associate Professor in the Department of Risk and Insurance at the University of Wisconsin-Madison. His research interests are in the economics of insurance markets, insurance company operations, and public policy issues in insurance.

Jim Swanke is a retired Senior Director of Risk Consulting with Willis Towers Watson specializing in financial and strategic planning issues, including risk financing design and evaluation, captive insurance company design, enterprise risk management, vendor selection/review, risk management organization design, facultative reinsurance placements, and regulatory compliance. Jim currently serves as Director of the Risk Management and Insurance MBA program at the University of Wisconsin-Madison, and he lectures on a variety of risk management topics.

Jim Swanke is a retired Senior Director of Risk Consulting with Willis Towers Watson specializing in financial and strategic planning issues, including risk financing design and evaluation, captive insurance company design, enterprise risk management, vendor selection/review, risk management organization design, facultative reinsurance placements, and regulatory compliance. Jim currently serves as Director of the Risk Management and Insurance MBA program at the University of Wisconsin-Madison, and he lectures on a variety of risk management topics.