Part 3: How to Balance Project Portfolios

Read Part 2: The Enterprise Staging Project Pipeline

By: Barb Schrage

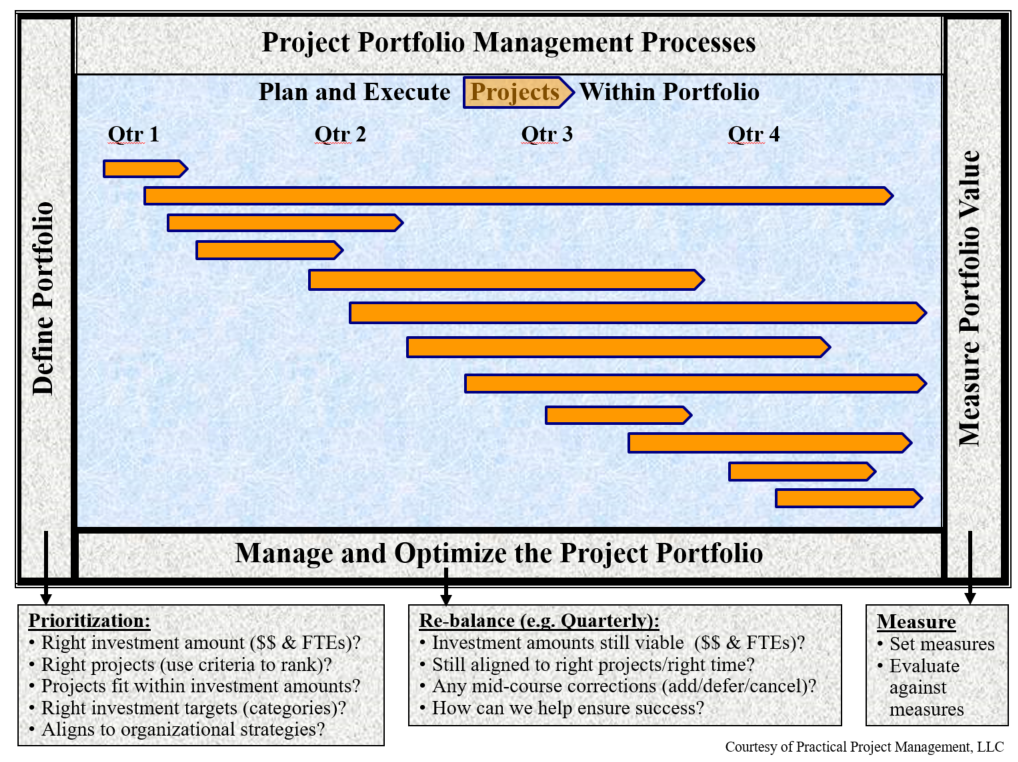

Once the project portfolio has been defined and approved, it needs to be optimized and re-balanced for performance and business value within resource capacity constraints. The frequency depends on the size of the projects and programs within the portfolio. For example, a company with fast-moving, quick projects, could re-balance monthly or quarterly.

There are various factors that could trigger a need to re-balance the project portfolio. The goal is to ensure the right projects are being worked on at the right time for the right cost and still fall within the budget and resource capacity of the project portfolio. Here are some examples:

1. External and internal factors may cause organizational and business strategies to change. For example, an external factor might be a new regulatory requirement or a change to the business or competitive environment. An example of an internal factor might be a change in corporate direction – perhaps a merger or acquisition or perhaps an internal reorganization. The project portfolio may need to incorporate changes to align with the new direction to ensure optimal business value.

2. There could be new project proposals submitted that may actually have higher priority than other projects currently in the portfolio.

3. Project status and performance of in-progress and completed projects can also affect the portfolio. For example, if the target date for an individual project is forecasted to complete later than planned, it may take more money and more time to complete the project, which may delay the start of new projects in the portfolio. If the actual costs for a completed project are overrun, it may affect how many projects can get done within the portfolio.

Once the portfolio has been re-balanced with recommended changes, it should be presented to the project portfolio governance team to re-gain approval. Questions to ask during this process include:

1. Is the project portfolio still aligned with the right projects at the right time to achieve the strategic and business objectives?

2. Are the investment targets for the portfolio (budget and resource capacity) still viable? Is there a way to increase capacity and/or efficiency?

3. Are there any mid-course corrections needed, such as adding new projects, deferring projects or canceling projects? With project portfolio management, there is a much greater degree of transparency in visualizing the impacts of a non-performing project on the entire project portfolio.

4. Do the project budgets and resource needs still fall within the financial and resource capacity?

5. What else can be done to help ensure the success of the entire project portfolio?

Set and measure the results of the project portfolio

There are two types of portfolio measures; the aggregate business value achieved by the projects within the portfolio and project performance of each of the projects within the project portfolio. Tracking each project’s individual business value contribution, both forecasted (for in-progress projects) and actuals (for completed projects) to the portfolio and then totaling for all projects within the portfolio is one way to measure business value.

Project performance measures are based on the “triple constraints” of project management; were the project’s final deliverables completed on time, within budget and according to scope and requirements? Track each project’s performance measures, both forecasted (for in-progress projects) and actuals (for completed projects) within the portfolio.

Both of these types of measures are integrated within the portfolio’s fiscal calendar timeframe. As mentioned earlier this could be on a rolling quarterly or annual basis, depending on the size of projects and how fast the projects are moving through the project pipeline.

The purpose

Coupled with a strong project management foundation of excellence in planning and executing projects, using these project portfolio practices will help to ensure success in optimizing resources and achieving an organization’s strategic and business objectives. The approved project portfolio represents clear direction and priorities for investments in budgets and in resource allocations toward the projects within that portfolio. If project performance metrics are tracked on an annual basis, they may show internal trending results of a steady percentage increase in projects, year after year, in meeting their target dates, project budgets and scope/requirements. The goal is to get more projects completed within a fiscal year using the same number of resources.

Barbara Schrage, PMP, MCPM, teaches Project Portfolio Management at the Wisconsin School of Business Center for Professional & Executive Development. To learn more about her upcoming courses, please contact [email protected] .

About the Instructor: Barb Schrage

Barbara owns a consulting business called Practical Project Management, LLC. She helps her clients mature their project management practices in various ways, such as implementing Project Management Offices, implementing Project Portfolio Management, and standardizing and improving their project management processes. Besides teaching classes within UW’s Masters Certificate of Project Management series of courses, she also teaches on-site Project Management courses within organizations. In addition, she coaches and mentors leaders of PMOs and Project, Program and Portfolio Managers. Besides her experience in the Financial Services industry, her clients have spanned various industries, such as health care, energy/utility, engineering, manufacturing, biotech research, government, retail, and market research.