How Business Acumen Can Deliver Real Business Impact

By: Dan Topf

Recently, a friend invited me to join a meeting of the Practical Farmers of Iowa. Being an Iowa farm boy, I thought I would tag along to learn about sustainable farming practices. What I saw surprised me; it was the Circuit of Capital playing out before my eyes. This model can help anyone understand what’s going on in their company and how business acumen can drive real impact.

All businesses require capital

Farming requires capital and farmers need it to move quickly. Lots of their money goes out to suppliers, machinery stores, veterinarians, farm stores, bankers, and other stakeholders. Then time passes, and the farmer sells crops, cattle, chickens, or other produce and gets paid. Think about it the next time you’re at a farmer’s market – how long has that vendor been spending money to produce that loaf of bread or jar of jam?

Increasing every level of employees’ business skills and competency leads to faster capital circulation.

The model

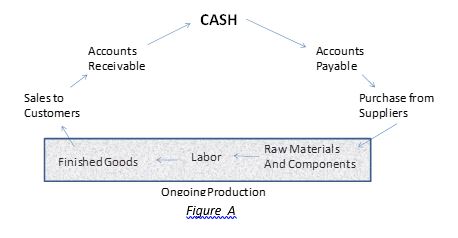

In general, the Circuit of Capital works like this (see figure A). A business starts and ends with cash. Capital (a.k.a. money) starts moving when the business uses cash to buy raw materials from a supplier. Then, the company applies labor to the raw material to produce a finished product. These finished goods are sold to a customer, who pays the company to complete the circuit from cash to cash.

Let’s look at an example. Oshkosh Corporation “is a leading manufacturer and marketer of access equipment, specialty vehicles, and truck bodies for the primary markets of defense, concrete placement, refuse hauling, access equipment, and fire and emergency.” Cash leaves the company to purchase steel, electronics, and other parts from suppliers. Next, Oshkosh employees (labor) fabricate the steel, prepare the components, assemble the trucks, and prepare them for delivery. The finished products are placed in dealer inventory for a customer to buy. A customer places an order, takes delivery, and pays their bill.

Fixed costs are also part of the circuit. Things like sales, general, administration, and research require capital and have an expected return. How quickly are those cash flows returned to the company?

Circuit of Capital v. the value stream

The Circuit of Capital is a broader notion than the value stream. A value stream (or value chain) typically starts with the supplier and ends with finished goods. The Circuit of Capital begins and ends with cash. It includes the necessary steps of accounts payable (the time it takes the company to pay for raw materials and components) and accounts receivable (the time it takes the customer to pay for finished goods delivered).

What can be done?

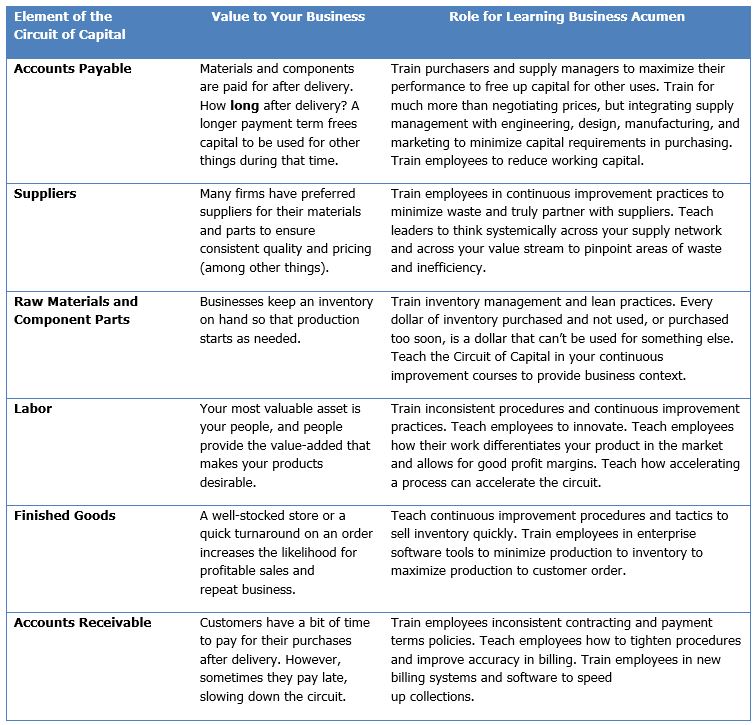

The idea is to have more cash coming in than going out during a given period. This circuit needs to move as quickly as possible. Some companies take months to complete a single circuit. Others take only a few days. How long does it take your company? How can you speed things up? How can you reduce the need for capital in the first place? The answers to these questions start with a reading of the overall business goals and objectives. Then, we can strategically apply work improvements to further these goals. Sounds difficult, but it’s straightforward. Consider these applications of business acumen to improving the Circuit of Capital:

A model like the Circuit of Capital can be very helpful for most organizations, and it’s a framework that will deliver real business value and give your team immediate credibility.

About the Instructor: Dan Topf

Dan is a successful performance improvement consultant who is passionate about helping people and businesses achieve dramatic performance improvement through learning. His imaginative and professional presentations produce outstanding results, as documented by attendees’ performance and businesses’ improved impact.