By: Dan Topf

“Wow! That’s sticker shock!”

Who hasn’t felt sticker shock when shopping these days? It’s almost like some merchants are insulting you with their prices. Recently, I paid as much for a single serving of my favorite beverage at a sporting event as I would have paid for a case at the grocery store. I complained, and my wife pointed out that I still had a choice. Nonetheless, I still bought it.

Customers look at pricing very differently than businesses do. Businesses have overhead, fixed costs, variable costs, owners, and other interests that affect the prices they charge. Customers are simply looking for the best deal.

Or are they?

Value, not price

If you think about it, customers are looking for the best value, not necessarily the lowest price. This principle is important. Everyone in your company must align to the value the business provides, otherwise your products and services are “the same as” everyone else’s. A commodity, if you will. I would guess that your senior management does not view your company as a “commodity.”

A business will be successful if it can charge a bit more for its product or service than it costs to produce it. This is a fundamental rule of business and, some say, the only rule of business. Yet it takes a bit of thought to apply this rule to your specific business.

Here’s an example: Let’s say you’re an aircraft engine manufacturer. You’re paid $1 million to deliver an engine to Boeing. It costs you $750,000 to produce it. Good deal? Perhaps. With a volume of one engine delivered, you’ve made a cool quarter of a million dollars.

How about another example. Now, you’re an ice cream novelty company making ice pops. You’re paid $1 to deliver one ice pop to a customer. It costs you $0.75 to produce it. Good deal? Perhaps. With the same volume, you’ve made a cool quarter. Ouch.

You see, pricing is one thing, but the relationship between the price we charge, its margin, and the volume of our sales, is quite another. Sure, if we charge enough, we don’t need to sell much volume to make enough profits. However, if we charge a low price, we need to sell quite a bit more to make the profits we need.

Different pricing strategies have different results

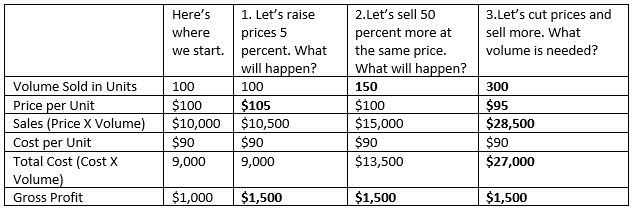

Below, I’ve illustrated three pricing strategies. Which one makes the most business sense?

Example 1: Look what happens when we raise prices at the same volume sold. Our prices went up 5 percent but our profits went up 50 percent. We call that leverage.

Example 2: Look what happens when volume increases 50 percent, but our gross profit also goes up 50 percent. That tells us that simply selling more volume may not be as efficient to our bottom line.

Example 3: Finally, look what volume we need if we reduce our prices and expect to make the same profits improvement. Wow! We’d need to double our volume to meet the same target that a 5 percent price increase earned us!

So, should we raise prices? Not necessarily. A more realistic and pragmatic view is to charge for the value you provide. Listen to the voice of the customer and study how they respond to pricing. You want to get the pricing and volume right, so you can maximize the potential returns.

Three questions to consider before changing prices

1. What would happen if you reduced revenues by 5 percent but kept volume constant? What impact would that have on profit?

2. What if you sold 10 percent more volume at 10 percent lower prices? What impact would that have on profits?

3. What if you sold your products at 2 percent higher prices, with value-added services? What volume decrease could you see and still be more profitable than if you did nothing?

Celemi, the business learning company, has a nifty tool to help you do this comparison.

Your leadership is likely working on these questions as we speak. Each function at your company ought to align its content to drive the price and volume strategy at your company. If you’re focusing on volume, are your people efficient, low cost, accurate, and timely? If you’re focused on pricing, are your people experts in their field, knowledgeable, in demand, innovative, and differentiated?

By understanding price and volume, everyone in your company can better align their efforts toward business success. The price we charge and the volume we produce have a direct impact on the overall success of the company. Your leadership has a strategy for moving this forward for your company. How are you aligning training to deliver it?

Dan Topf teaches Finance and Accounting for Non-Financial Professionals at the Wisconsin School of Business Center for Professional & Executive Development. To learn more about his upcoming course dates, please contact [email protected].

About the Instructor: Dan Topf

Dan is a successful performance improvement consultant who is passionate about helping people and businesses achieve dramatic performance improvement through learning. His imaginative and professional presentations produce outstanding results, as documented by attendees’ performance and businesses’ improved impact.