By: Harvey Bergholz

A wonderful executive I worked with for years was fond of saying to the senior team at each year’s strategy review meeting, “You can’t stand still on a bicycle. It’s either forward or backward and forward means growth. Let’s find the high-growth routes for the future.” The executive would then remind the group of the central questions to tackle:

- Where are the most attractive opportunities for growth the next three-to-five years?

- What are our best opportunities to strengthen our revenue and profit streams, create new ones for the long-term, or gain market share and enhance our margins?

- Which of the many growth opportunities out there are we best suited to dominate, or at least differentiate, given our core competencies and what we’ve done well in the past?

Answers to these, and other questions are at the heart of effective strategic planning; but, how to get there? How does a group – at the corporate, division, or functional level – navigate the labyrinth of routes that can lead to a realistic, actionable set of outcomes for strategic goals, supporting core strategies, execution plans, and operating plans?

In this brief article, let me introduce you to Igor, a very old friend of the process. We can’t cover the dozens of ways to lead or facilitate a strategy development or strategic planning process; there is not enough space here for that. However, I can introduce you to Igor Ansoff and one of many productive tools to facilitate your brainstorming, debate, and analysis sessions. Such tools are valuable for a group attempting to categorize and prioritize potential growth opportunities they have identified in the early stages of a strategic planning process.

The Ansoff Matrix

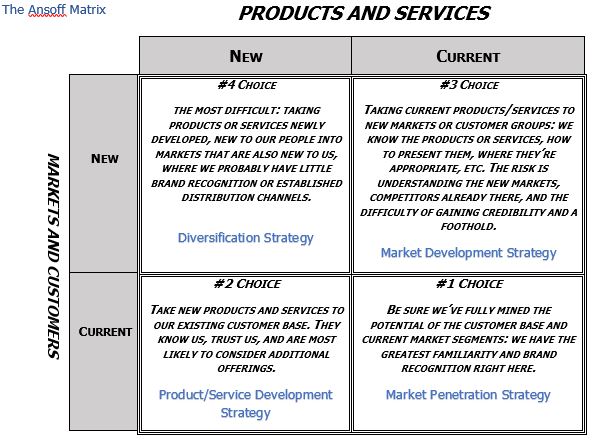

In 1957, Mr. Ansoff, a Russian writer, thinker, and business person, offered the world his simple framework as a tool for considering where to explore and invest in growth opportunities. Though not essential in every strategy process, the tool has been a useful device for facilitating groups as they try to categorize, sort, and prioritize the array of opportunities to consider. The simple four-square matrix requires disciplined thought, research, and discussion to get the most from it, as it is deceptively simple.

Take a moment to review it, and then we’ll hit a few highlights that should help bring it to life, along with an example.

Ansoff’s matrix is a lovely framework for considering the four basic growth strategies a group can explore. The Market Penetration Strategy calls for filling the gaps where we currently play: gain share by selling more products or services to current customers or gaining more such customers in our current markets. Basic tactics underlying this growth strategy include:

- Invest more in marketing, sales, advertising, promotion

- Price and terms adjustments

- Acquisitions

- Modifying or customizing P/S lines to attract specific, larger customers

Basic tactics for the Product/Service Development Strategy include:

- Invest in R&D to develop new products or services

- Acquire new products or services, or the rights to them that will appeal to current customers

- Execute a joint venture or outright acquisition

If we try to enter new markets (i.e., geographic, customer groups, industries) with our current products/services lineup, we’ll pursue a Market Development Strategy, where the basic tactics include:

- Invest in sales and marketing talent to create awareness and interest

- Tailor the products or services lineup to ensure high appeal

- Execute a joint venture or outright acquisition to gain entry

- Focus on market segments that are similar to the current ones where we have success

The most difficult strategy is Diversification, where we attempt to develop and introduce new products or services into markets that are also new to us. In this, the company takes on a dual challenge of development. Pursuing “related diversification,” rather than unrelated diversification, can mitigate the risk somewhat, but this remains the riskiest of the four strategies. In the extreme, consider the conglomerate organization that grows by collecting businesses which may or may not be related to one another. Basic tactics include:

- Acquisitions of products, service lines, or whole businesses

- Investing in R&D to develop new products or services targeted to new markets

Assuming the team can identify one or more growth opportunities to consider seriously, the process moves forward with a deeper analysis of each. We want to ensure the strategy fits with the company’s available investment dollars, talent, competencies, and so on. A good, solid business case would be drafted to support each selected opportunity. These would fuel the group’s review, discussion, and debate. These cases should include financial modeling as well as strategy execution and operational planning elements.

An Ansoff Matrix Example

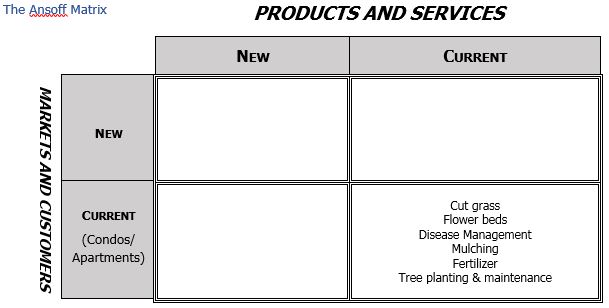

Twenty-odd years ago, a successful, family-owned, regional landscape maintenance company sought to expand and grow. At the time, their Ansoff Matrix looked like this:

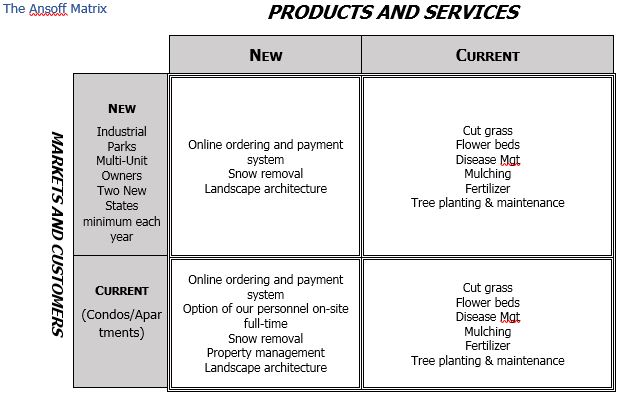

Over several years, with a strategic review and update each year, the company moved to this picture:

Over time, the company added new services (online ordering, snow removal, etc.) to their current markets and customers. It then took three of the five new services, along with the original “current products or services” set to new markets and customers (industrial parks, multi-unit owners, etc.).

This company became the largest in the U.S. and national in scope by first focusing on a Market Penetration Strategy and then by developing competencies in new services and offering them to current markets and customers (Product/Services Development Strategy). Next, they took a double-edged approach by taking most of those services (old and newly added) to new markets and customers – both geographic and by segment, combining a Market Development Strategy and related Diversification.

This tool, the Ansoff Matrix, was a simple device to launch and guide the strategy development efforts over a five-year growth arc that enabled the company to become the market leader nationally.

© Jeslen Corp 2017

About the Instructor: Harvey Bergholz

Harvey has experience as president of Jeslen Corp., a management consulting firm. Jeslen Corp. consults across industries and organization sizes, focusing on strategic planning, organization development, facilitation, and performance management. Working mostly with senior management and boards, Harvey and his team design and deliver tailored approaches to problem-solving and decision-making situations in organizations large and small, public and private.