By: Dan Topf

Cash is the life blood of any business. Cash matters. Cash is King. Cash may be more important than profit. According to a New York Times article on the cause of business failures, four of the 10 reasons cited link directly to cash. And here’s one more quote, “In God we trust. All others pay cash.”

You get my point?

I remember when I was in college I frequently ran out of money before I ran out of “month.” When that happened, I was forced to use credit or go without. This is true for any company as well. The more we align our decisions to help employees drive cash availability, to use cash wisely, and to generate more cash for the company, the better.

To start a business, the first thing you need is cash! Even if you have a stellar business idea, you go nowhere without the cash to get started. Cash is freedom to act.

Statement of Cash Flows

Cash is tracked on the Statement of Cash Flows. It’s a financial statement on par with the Income Statement and the Balance Sheet. All companies have one, and it’s vital that we understand how it works and how the business decisions we make affect it. The statement tracks the changes in the cash balance of the business over the period in three parts: Operating Activities, Investing Activities, and Financing Activities.

When the cash balance on the Balance Sheet changes, we want to know what business decisions and results explain why. With a keen eye to the Statement of Cash Flows, you can begin to see how a business generates either positive or negative cash flows.

Operating cash flows stem from the business’ core operations. These are the inflows and outflows of cash for inventory, cost of goods, revenues, accounts payable, and accounts receivable.

Investing cash flows are derived from the business’ investment in capital equipment, assets, or investing activities. These are inflows and outflows of cash for plant, equipment, investment gains, and losses.

Financing cash flows show a business’ changes in debt, payment of dividends, and the raising of capital. These include inflows from short term or long-term loans.

Cash Discipline Can Be Tricky

As we all know by now, the idea is to have more cash flowing in than flowing out over a given period. It’s doubly important for everyone in an organization to understand how their decisions impact the ratio of outflow to inflow of cash.

All employees ought to have a cash discipline. That is, a general idea of when they spend a dollar, when will they get it back, and will it bring any friends (return) with it?

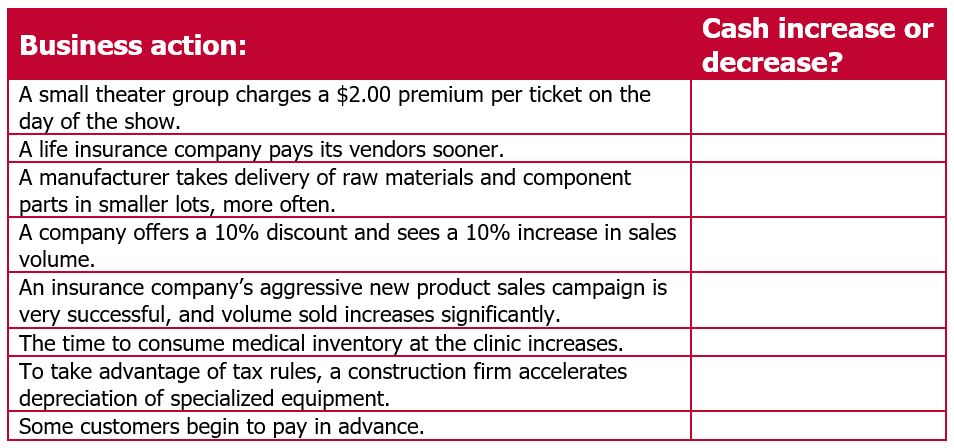

What do you think? Think you got it? Here’s a little test for you. Consider each item. Determine if you believe the business’ cash account will increase or decrease in each example. The correct answers may surprise you:

Read to the end to see the answers!

Cash discipline can be tricky. A decision to improve cash flow may have the opposite effect on profit.

Too many employees see the impact of their decisions on profit but fail to appreciate the impact on cash. Sure, you just won that big deal, but the deal’s structure may use up too much cash.

Profit is an “opinion,” and cash is “fact.” Accounting rules (GAAP or Tax) and conventions (Matching Principle) determine what values are material to the income statement for a business. There are lots of assumptions and estimates. As for cash, it’s simpler. Do you have it? If not, we either get it or we’re out of business.

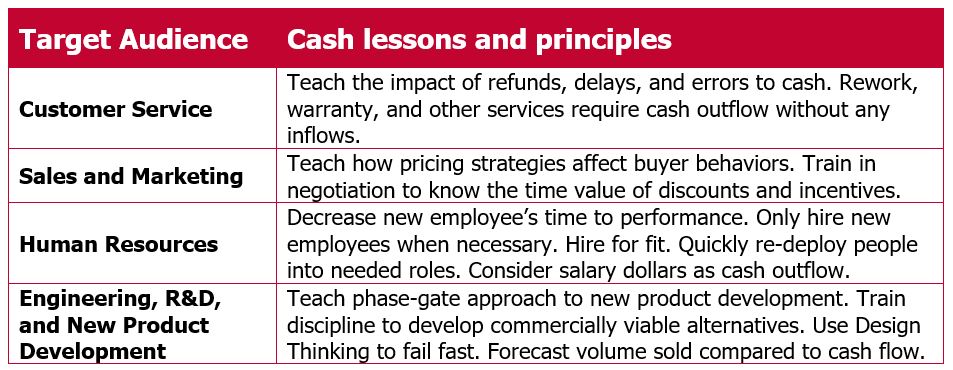

A Learning Approach

Here are my suggestions for leaders and managers about cash:

Yes, cash is of vital importance to the business. As we build business acumen in all our employees, we will see tremendous payoff as people use their understanding of cash to influence their day-to-day decisions.

You can learn more about how to better control cash flow in your organization in our Finance and Accounting for Non-Financial Professionals program!

Dan Topf, CPT is Senior Vice President for Performance Improvement at MDI, Inc. and adjunct faculty for the Wisconsin School of Business Center for Professional & Executive Development. He can help your organization better manage its cashflow and improve business activities. Contact us for more information.

Where to learn more:

Free online cash flow illustrator at www.MDI-Learning.com

Celemi Apples & Oranges, a business simulation available from MDI, Inc.

www.Investopedia.com, an online resource for investors of all types.

Answers!

1. Increase. The nominal increase does not affect sales volume

2. Decrease. Cash leaves the company faster.

3. Increase. Less cash is spent buying inventories at any given period.

4. Decrease. Even if you sell 10% more, the cost of goods sold increases also. The net effect is negative

5. Decrease. Insurance sales activity takes lots of cash for commissions and expenses up front.

6. Decrease. More cash is tied up in slow moving items.

7. No effect. Depreciation is a non-cash expense.

8. Increase. Customer pays sooner and money is collected faster

About the Instructor: Dan Topf

Dan Topf is a successful performance improvement consultant who is passionate about helping people and businesses achieve dramatic performance improvement through learning. Dan’s client list includes Accenture, Drake University, Sears, ING Group, ING Direct, PricewaterhouseCoopers, Wells Fargo, the Principal Financial Group, the Hartford Financial Services Group, GEA Group, Chubb, MetLife, Continental Western Group (a W.R. Berkley Corp.), CIGNA, the University of Iowa, and many more. Dan is a past president of the Golden Circle Chapter of the International Society for Performance Improvement (ISPI). Dan is an adjunct faculty member in the College of Education at Drake University, and he has served as assistant director of the Executive M.B.A. Program in the Henry B. Tippie College of Business at the University of Iowa.